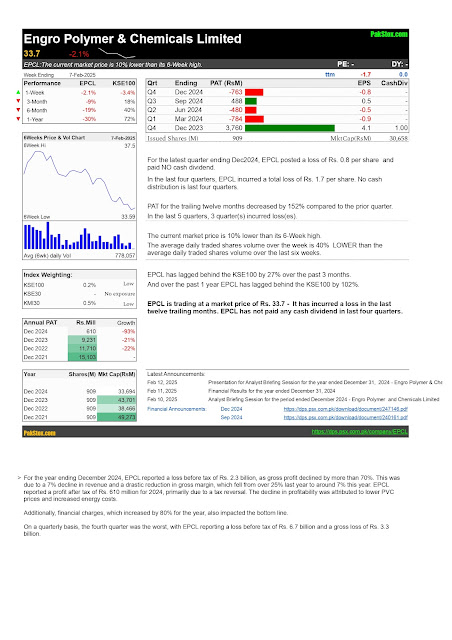

For the year ending December 2024, EPCL reported a loss before tax of Rs. 2.3 billion, as gross profit declined by more than 70%. This was due to a 7% decline in revenue and a drastic reduction in gross margin, which fell from over 25% last year to around 7% this year. EPCL reported a profit after tax of Rs. 610 million for 2024, primarily due to a tax reversal. The decline in profitability was attributed to lower PVC prices and increased energy costs.

Additionally, financial charges, which increased by 80% for the year, also impacted the bottom line.

On a quarterly basis, the fourth quarter was the worst, with EPCL reporting a loss before tax of Rs. 6.7 billion and a gross loss of Rs. 3.3 billion.

https://dps.psx.com.pk/download/document/247146.pdf