On Tuesday, 8th October 2024, the Pakistan Stock Exchange (PSX) maintained its upward momentum. The KSE-100 Index opened slightly down by 5 points but swiftly gained 914 points during the session, with only a brief intraday loss of 12 points. The index ultimately closed with a substantial net gain of 754 points, reaching 85,664. This follows the previous day's impressive gain of 1,378 points. Over the last five trading sessions, the KSE-100 Index has accumulated a total of 3,859 points. Year-to-date, the index has surged by 37%, highlighting robust market performance in 2024.

On Tuesday, major contributors to the KSE-100 Index included BAHL (+165 points), HBL (+162 points), EFERT (+144 points), OGDC (+108 points), and BAFL (+87 points).

On the downside, HUBC, MARI, LUCK, UBL, and FCCL dragged the index, contributing negative points to the overall performance.

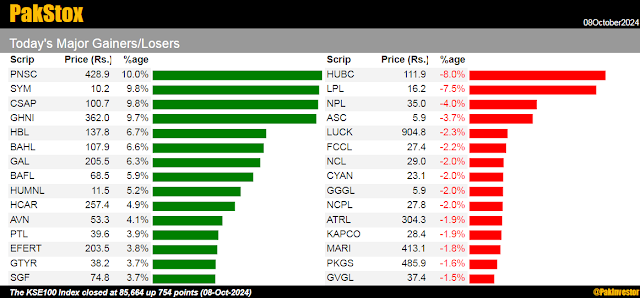

Major Gainers Today:

- PNSC (P.N.S.C) at 428.9, +10.0%

- SYM (Symmetry Group Ltd) at 10.2, +9.8%

- CSAP (Crescent Steel) at 100.7, +9.8%

- GHNI (Ghandhara Ind.) at 362.0, +9.7%

- HBL (Habib Bank) at 137.8, +6.7%

Top Gainers Over the Last 5 Trading Sessions:

- NCL (Nishat (Chun.)) at 29.0, +21.4%

- PPL (Pak Petroleum) at 128.12, +18.0%

- OGDC (Oil & Gas Dev.) at 172.14, +17.9%

- BAFL (Bank Al-Falah) at 68.5, +17.3%

- PNSC (P.N.S.C) at 428.89, +17.2%

Major Losers Today:

- HUBC (Hub Power Co. XD) closed at Rs. 111.9, down 8.0%.

- LPL (Lalpir Power) closed at Rs. 16.2, down 7.5%.

- NPL (Nishat Power) closed at Rs. 35.0, down 4.0%.

- ASC (Al-Shaheer Corp) closed at Rs. 5.9, down 3.7%.

- LUCK (Lucky Cement XD) closed at Rs. 904.8, down 2.3%.

Major Losers in the Last 5 Trading Sessions:

- LPL (Lalpir Power) closed at Rs. 16.19, down 18.7%.

- GVGL (Ghani Value Glass) closed at Rs. 37.44, down 17.0%.

- TPL (TPL Corp Ltd) closed at Rs. 4.23, down 15.9%.

- IBLHL (IBL Healthcare) closed at Rs. 26.58, down 12.7%.

- HUBC (Hub Power Co. XD) closed at Rs. 111.92, down 11.5%.