The effective tax rate for the quarter was 20%, a significant decrease from the 46% tax rate in the same quarter last year.

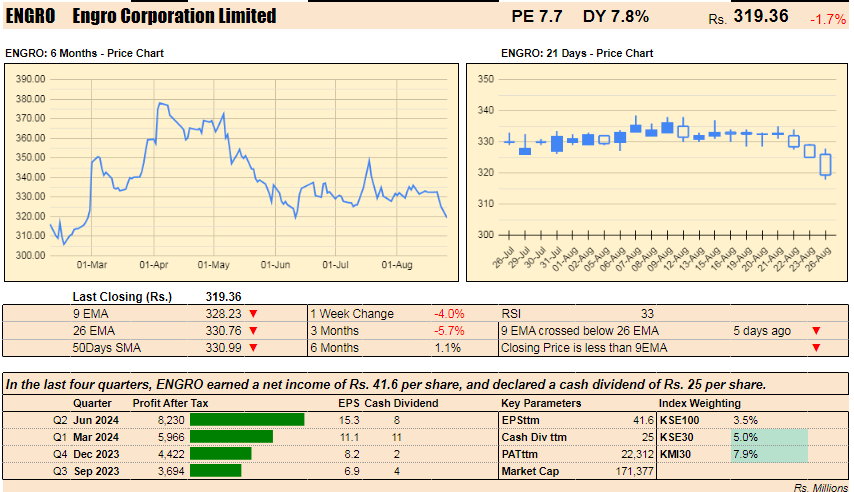

Over the last four quarters, ENGRO earned net income of Rs. 41.6 per share and declared a cash dividend of Rs. 25 per share. The company’s net income for the last four quarters is 27.5% higher than the total net income from the preceding four quarters.

ENGRO is currently trading at a price-to-earnings ratio of 7.7, with a dividend yield of 7.83%. Despite these positive financials, the stock has gained only 1.1% over the last six months. As a holding company, nearly all of ENGRO's revenue comes from dividend income.

The company holds 39.9% of FrieslandCampina Engro Pak Ltd (FCEPL), 56.27% of Engro Fertilizers, and 56.19% of Engro Polymer and Chemicals (EPCL).

ENGRO has a significant presence in PSX indices, with a 3.49% exposure in the KSE100 Index, 5.02% in the KSE30 Index, and 7.94% in the KMI30 Index.

Download Earnings Announcement

See Note on IMPACT OF UREA IMPORTED BY GOVERNMENT OF PAKISTAN