This past week was a whirlwind in the Pakistani market! A policy rate reduction, the presentation of the federal budget, a resurgence in international oil prices, and the PSX's impressive turnaround on a bad budget.

The KSE 100 Index extended its losing streak from last week into the first three trading sessions of this week. By Wednesday, it had shed over 3,000 points, remaining in the red zone for eight consecutive trading sessions since the beginning of the month.

The market's weakness stemmed from expectations of higher taxation in the upcoming budget, particularly an increase in the capital gains tax. Additionally, the market had reached record highs by the end of May, prompting participants to adopt a selling stance. This 'sell' sentiment was so strong that even the reduction in the policy rate, announced on Monday evening, was insufficient to reverse the market's direction. Consequently, the KSE100 Index lost an additional 450 points in the two trading sessions following the policy rate reduction.

The federal budget, presented on Wednesday evening, aimed to extract more from the existing weak and shrinking tax base, and at creating hurdles for small businesses in the informal sector. The informal or small business sector has proven to be the bedrock of Pakistan's economy, providing a level of resilience that has sustained the nation through the worst of times.

Among other drastic measures, such as ending the 1% presumptive tax regime for exporters, the budget also proposed eliminating the holding period concept for securities purchases. It suggested imposing a 15% capital gains tax regardless of the holding period.

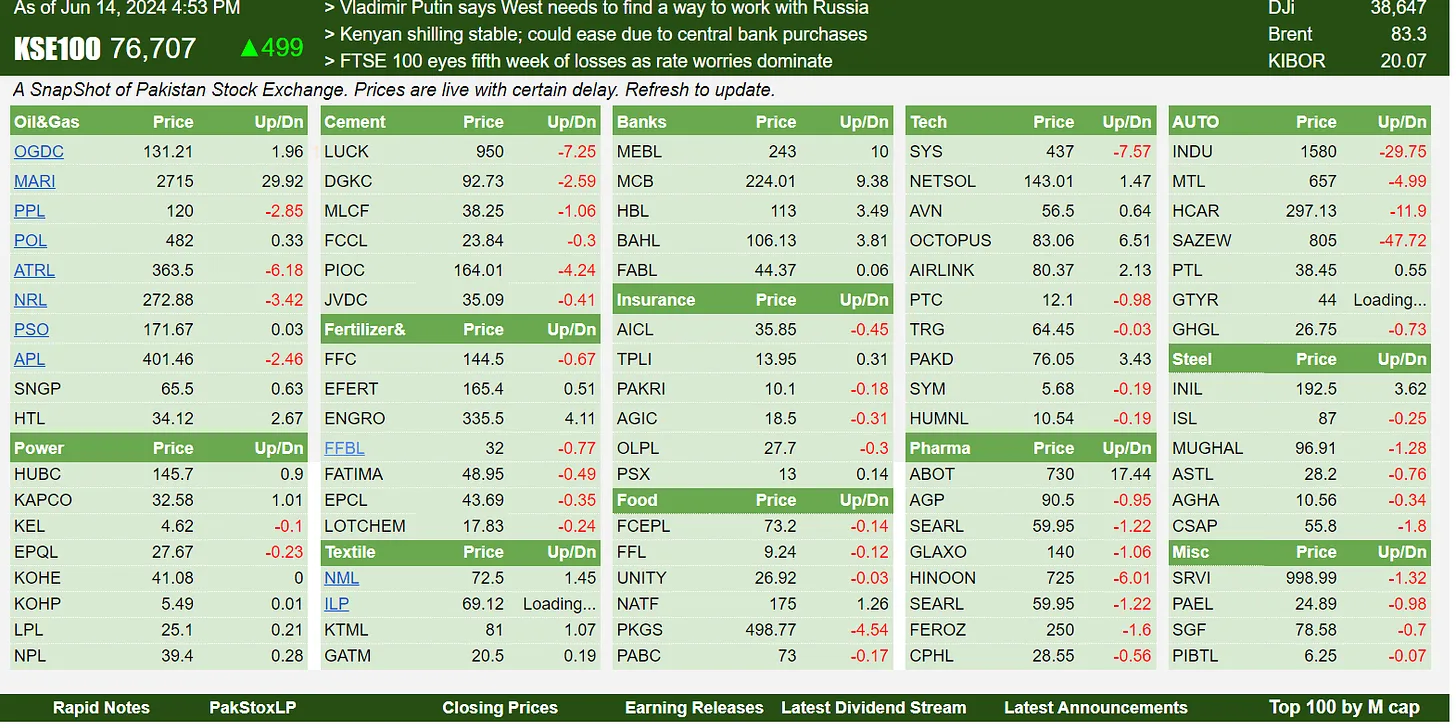

The day after the budget, the market rose by 3,400 points, or 4.7%. This rise was not a resounding endorsement of the budget proposals but rather an attempt to take advantage of the existing capital gains tax (CGT) regime, which is set to end on June 30, 2024. In the last two remaining trading sessions of the week following the budget, the market recouped all the losses it had sustained in June and reached another record high, crossing the 77,000 level intra-day.Take a look at how the PSX ended the eventful week. Investors did take profit taking opportunities wherever they could considering strong market resurgence and extended weekend on account of Eid holidays. Hence the red that you see on the screen shot of the last day of trading.

Foreign Corporates were net sellers this week of $ 3.57 million. This was there first attempt at selling at PSX after several months. But they were in line with the market trend. And on the last day of the week after the local investors pushed the market up in one day by 4.7% they turned net buyers and made a net amount of net buying of $2.25 million.

Follow the link to below to read more.