PIBTL | Pakistan International Bulk Terminal

Earning Release Q3-Mar 2024

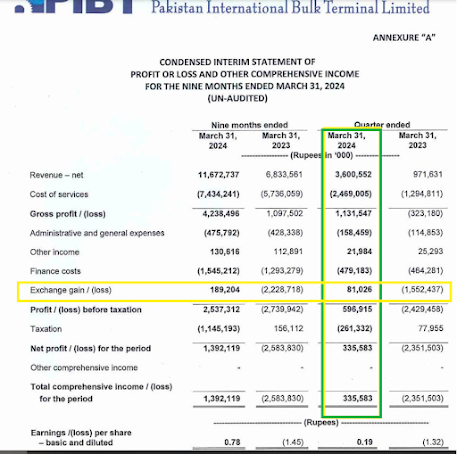

Announced earning per share (EPS) of Rs. 0.19, compared to a loss per share of Rs. -1.32 in the same period last year.

No dividend was declared in this period.

On a 9-month basis, PIBTL announced EPS of Rs. 0.78 compared to loss per share Rs. -1.45 last year.

PIBTL earned a profit after tax of Rs. 335.6 million for the third-quarter. Change on comparative figures of same quarter last year is not relevant as the company was sustaining losses. It is from fourth quarter last year that the PIBT has started turning a profit.

PIBTL now, on a twelve-month trailing basis, has a profit after tax of Rs. 1,818.3 million previously it was a loss.

In addition to problems with revenue the company is susceptible to exchange losses that hit the bottom line hard.

In this quarter PIBT booked an exchange gain of Rs. 81 million while last year it was a loss of Rs. 1.55 billion.

The tax rate for the quarter was 43.8%. The gross profit margin for the quarter was 31.4%.

PIBTL is trading at a marker price of around Rs. 6.8, and its market cap is Rs. 12,145 million.

PIBTL has a weighting of 0.25% in KSE100 Index 0.25%. In KSE30 and KMI30, it has no weightings.

https://dps.psx.com.pk/download/document/229792.pdf