As the KSE100 Index rose by 1,000 points today, Foreign Corporates bought a net amount of over $3 million, surpassing their recent activity at the PSX. Interestingly, Overseas Pakistanis were net sellers to a significant degree today, exceeding $2.46 million. Typically, their activity at the PSX is not very significant.

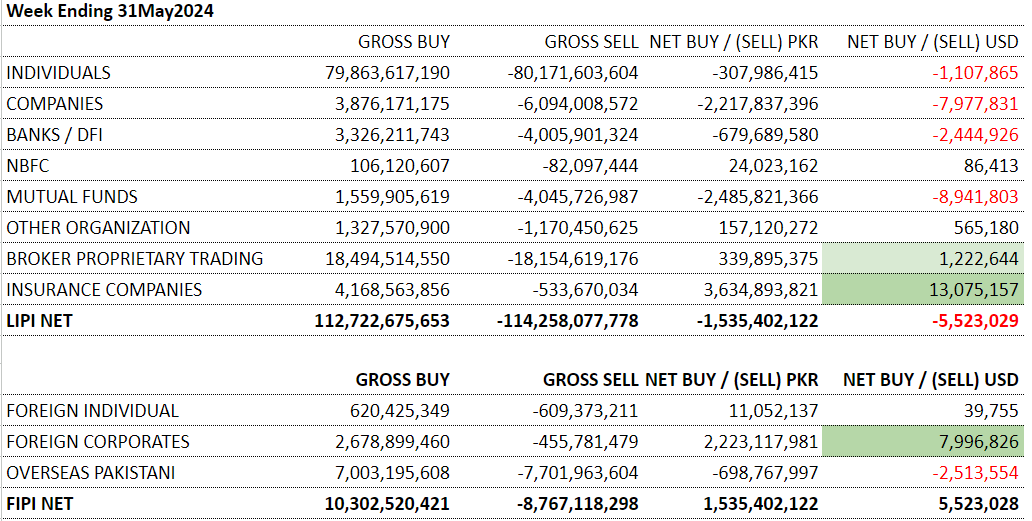

On a weekly basis, Foreign Corporates' net buying was close to $8 million, as the KSE100 Index declined by 105 points.

In 'Local Investors' Mutual Funds were net buyers today, but the amount was relatively small at $0.4 million. In contrast, individuals were major sellers, with net sales of $3 million. The activity of Mutual Funds is most significant when a clear trend emerges, which has not yet occurred. This week, they have sold more than in any other week of this year, with net sales close to $9 million.

Another major seller this week was 'companies,' with net sales close to $8 million, nearly matching the sales by mutual funds.

The most significant activity this week came from 'insurance companies,' which made net purchases of over $13 million. In this last week of the month, they were most active, investing twice the amount they did in the first three weeks of the month.

Insurance companies have taken an approach to the PSX that sharply contrasts with other local investors. In terms of institutional investment, their strategy is more investment-oriented rather than opportunistic. On the other hand, mutual funds' institutional investing is influenced by portfolio structure and redemption pressure resulting from their unit holders' opportunistic approach.

In May, every local investor was a massive seller except for insurance companies. Year-to-date, every local investor is in the red except for the Insurance Sector. Year to date they have made a net purchases close to $60 million, everyone else in local investors was in red.

Keep watching this activity.

This week was generally a time for local investors to sell, with the market at a record high and the federal budget announcement looming next week. The continued buying by foreign corporates is noteworthy. However, it's important to remember that this net buying represents only a small fraction of their previous net sales of over $1.5 billion in the past five years.